Residential Rental Market Trends in NY

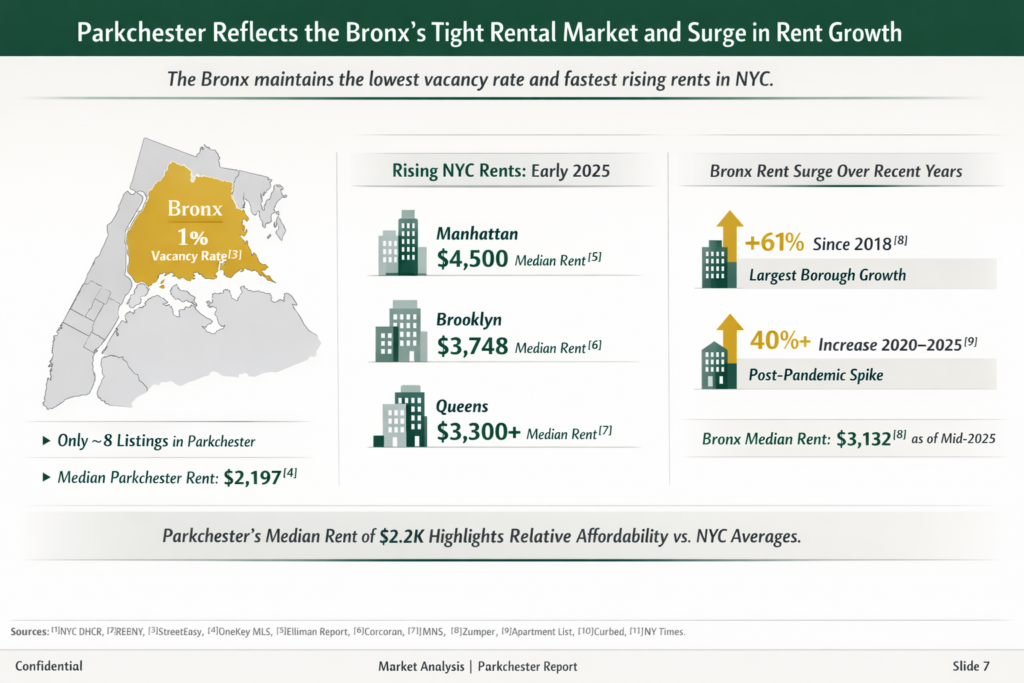

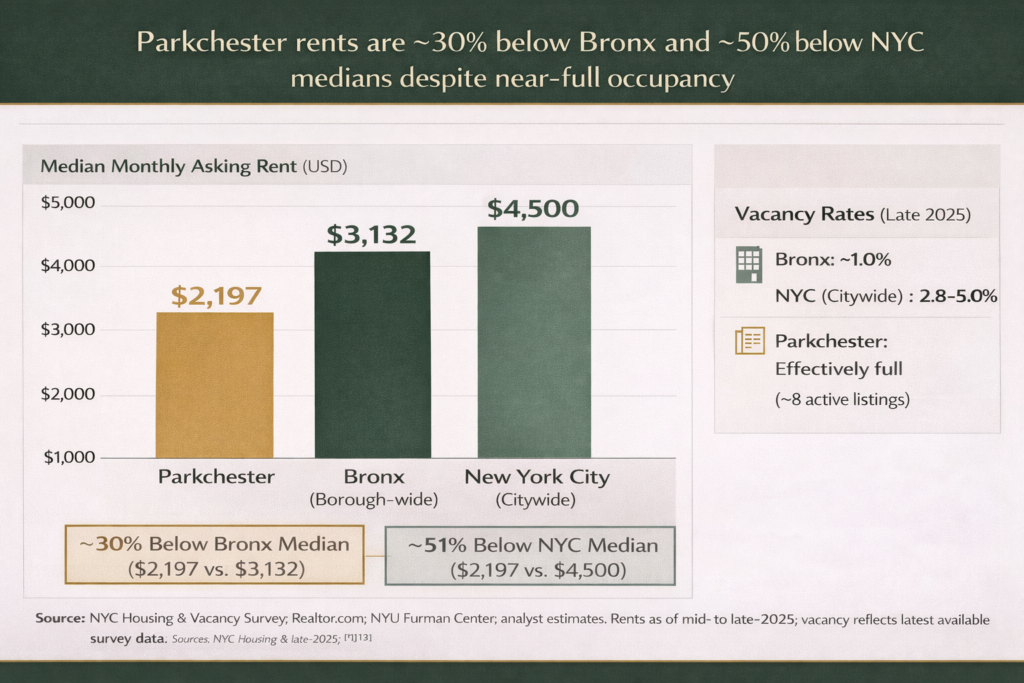

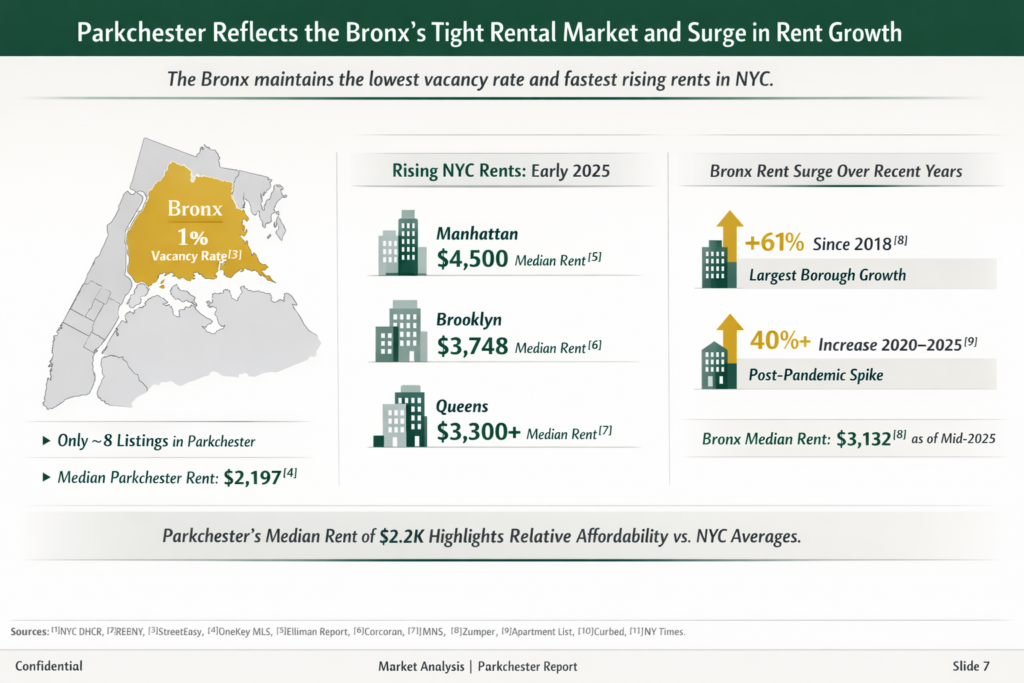

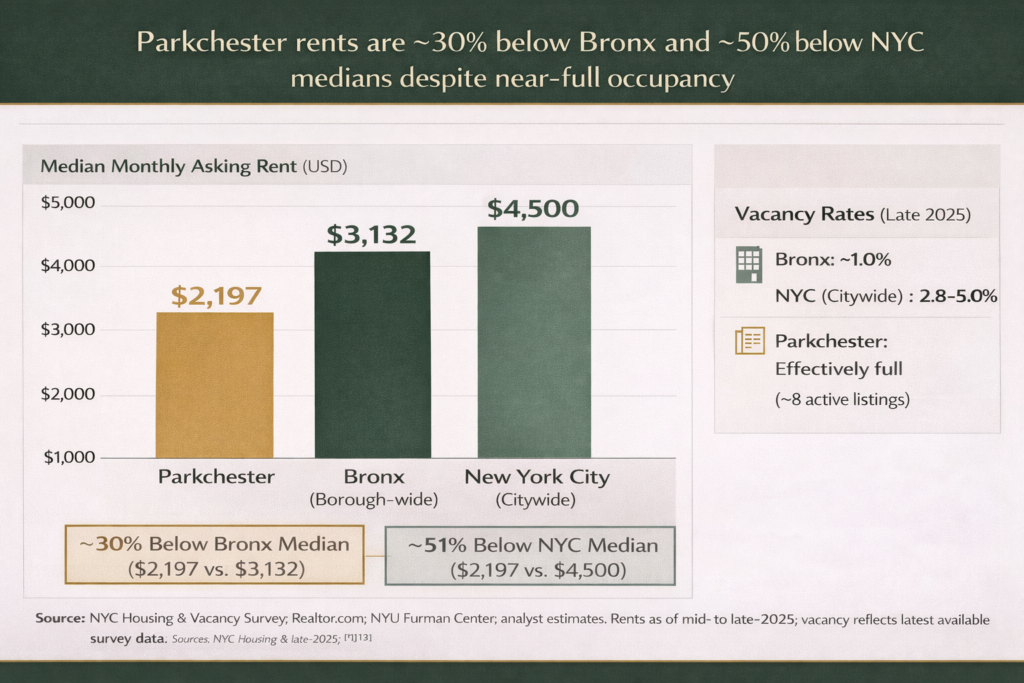

Parkchester sits within the Bronx, a borough currently experiencing one of the tightest rental markets in New York City. Citywide apartment vacancy rates are near historic lows (~2.8–3.0%), underscoring intense demand and limited supply[1][2]. The Bronx leads in occupancy – effectively full at ~1% vacancy, meaning virtually every available unit is leased[3]. Parkchester reflects this dynamic: only ~8 rental listings were on the market recently, with a median asking rent around $2,197[4]. Such scant availability signals robust demand and high occupancy in this community.

Rental prices have surged to record levels across NYC. As of early 2025, the median asking rent in Manhattan reached about $4,500 (with average 1BR rents ~$4,640)[5], and Brooklyn’s median was roughly $3,748[6]. Queens asking rents have also exceeded $3,300 on average[7]. By comparison, Parkchester’s median rent of $2.2K per month[4] highlights its relative affordability, even as Bronx rents have climbed rapidly. In fact, the Bronx saw the largest rent growth of any borough in recent years – +61% over the last 6 years[8] – pushing the median asking rent to about $3,132 as of mid-2025[8]. This growth follows a post-2020 spike: Bronx rents jumped over 40% from 2020–2025[9]. Rent increases have since moderated (only ~0.7% early-2025 uptick in the Bronx[9]), but rents remain at all-time highs. Even traditionally affordable areas are seeing record rents[10]. Today, Manhattan rents still average roughly 40–50% higher than Bronx rents[11], yet the gap has narrowed amid the Bronx’s recent surge. For Parkchester specifically, rents are near their highest levels on record, though still offering a discount to the city core.

Despite robust rent growth, Parkchester and the Bronx maintain a pricing advantage on a per-square-foot basis. Parkchester units (often one- and two-bedroom condos in mid-rise buildings) have asking rents that translate to ~$30–$35 per sq. ft. annually, significantly lower than premium Manhattan neighborhoods that routinely achieve double that rate. Occupancy in Parkchester remains very high, reflecting strong tenant demand for its more attainable rents. In sum, the residential rental trend in Parkchester is one of rising rents and constrained supply, but with absolute rent levels that are still moderate compared to Manhattan and Brooklyn. This combination yields a compelling value proposition for renters – and by extension, landlords – in Parkchester’s submarket.

Macroeconomic & Demographic Trends

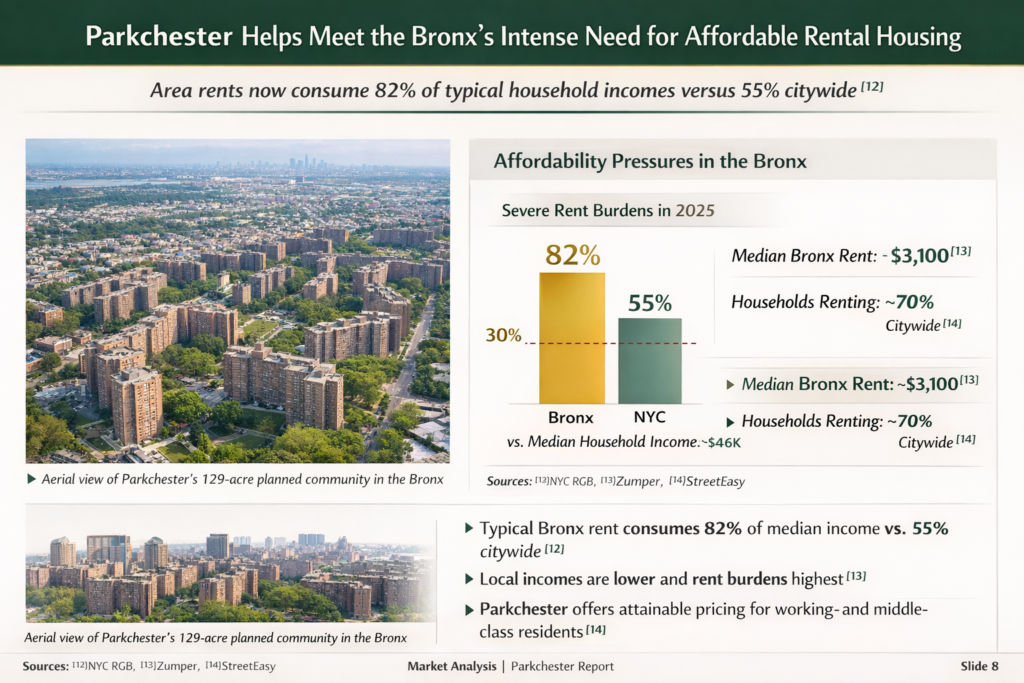

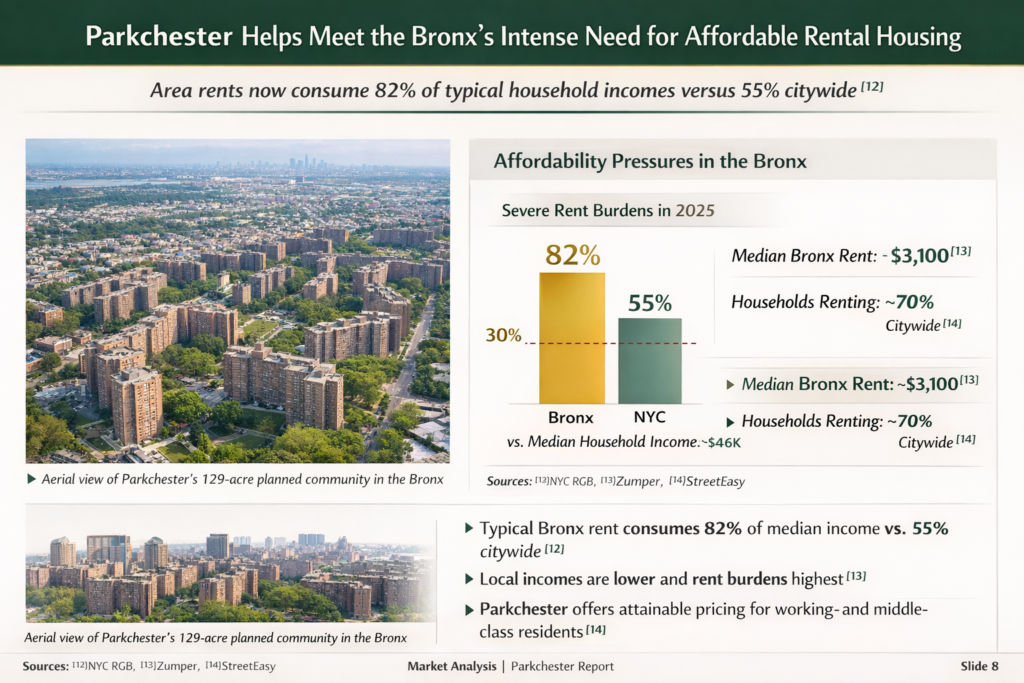

Aerial view of Parkchester’s 129-acre planned community in the Bronx, showing its cluster of mid-rise apartment buildings amid surrounding neighborhoods. Parkchester’s market must be understood in the context of broader economic and demographic currents in New York City. Affordability is a central concern: as of mid-2025, the median NYC rent consumes ~55% of a typical household’s income[12] – far above the 30% guideline – and the strain is most severe in the Bronx. In the Bronx, median asking rents now equate to an astonishing ~82% of household income (versus ~57% in Manhattan)[13]. Incomes in the Bronx are lower (median ~$46K) and rent burdens higher, even as the borough historically offered the cheapest rents. This means demand for affordable units is intense, but it also underscores the importance of rental housing that remains within reach of local workers. Parkchester plays a key role here, providing reasonably priced housing (relative to NYC norms) for working- and middle-class residents. Notably, even at ~$2.2K/month, Parkchester’s median rent is below the city median – a rarity in a city where 70% of households rent and many areas have become unaffordable[14]. The need for housing at attainable price points supports sustained occupancy in Parkchester, though it also highlights renters’ sensitivity to income trends and employment stability.

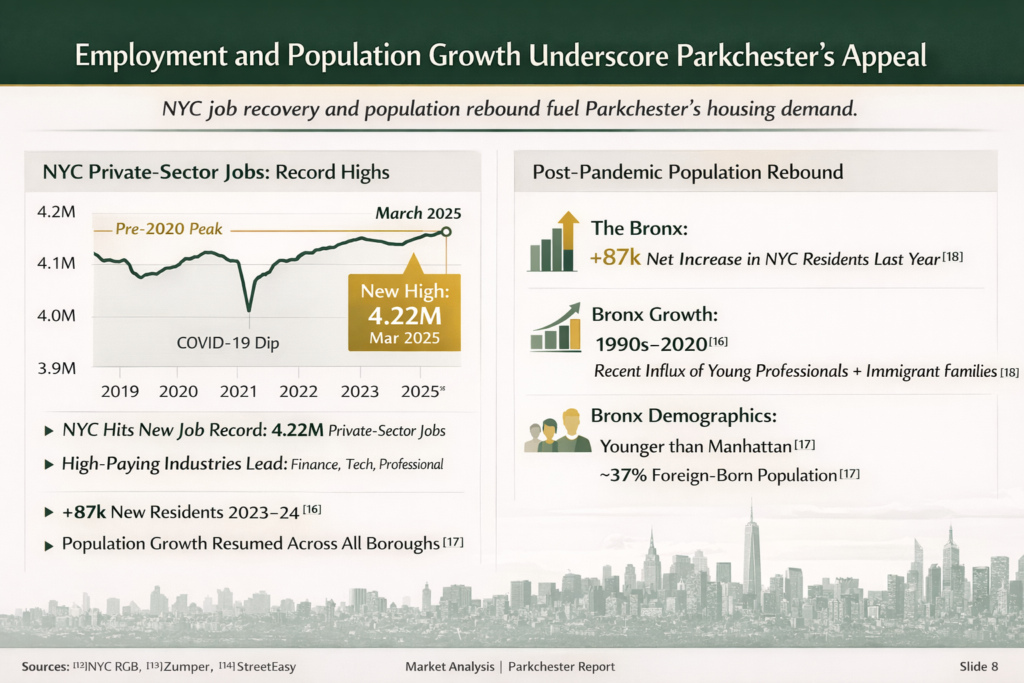

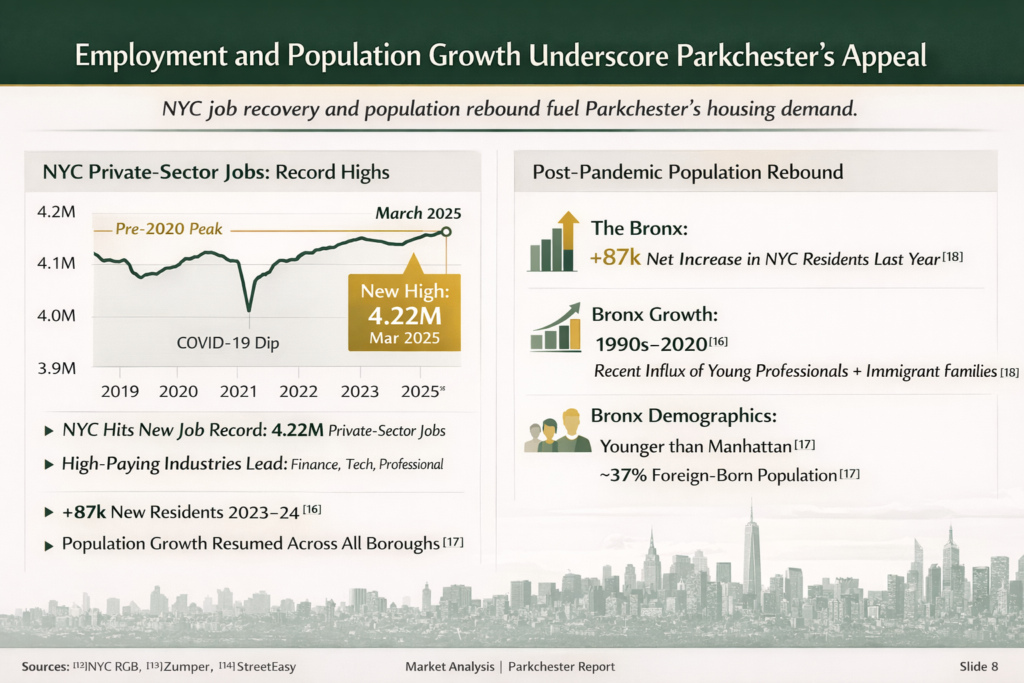

Employment and population trends in NYC further bolster the Parkchester thesis. New York City has rebounded strongly from the pandemic: by March 2025 the region reached 4.22 million private-sector jobs (4.82M including government), exceeding pre-2020 peaks[15]. Crucially, many of these job gains are in high-paying industries (finance, tech, professional services)[15], which fuels housing demand across the city. While Manhattan captures a large share of these jobs, the Bronx benefits indirectly – through secondary employment growth and via commuters seeking more affordable residences. The Bronx had been enjoying steady population growth from the late 1990s up to 2020[16], and after a brief pandemic dip, all NYC boroughs resumed growth by 2023-2024[17]. This return of population (NYC added ~87,000 residents in the year ending July 2024)[18] signals that the city’s allure remains intact. Parkchester’s family-friendly, community-oriented environment (noted for its landscaped oval, parks, and retail amenities) positions it well to capture households who might be priced out of Brooklyn or Queens. Demographically, the Bronx skews younger than Manhattan and has a large immigrant community, contributing to household formation and rental demand. An influx of new residents, from returning young professionals to immigrant families, continues to drive demand for Bronx housing – particularly in well-connected, services-rich neighborhoods like Parkchester.

Perhaps the most game-changing macro development for Parkchester is infrastructure investment. The MTA’s $3 billion Penn Station Access project will create four new Metro-North commuter rail stations in the East Bronx (including one at Parkchester/Van Nest), slated for completion around 2027[19][20]. This new transit link is set to transform Parkchester’s connectivity. Currently, residents rely on the <em>6 Train</em> subway, taking about 50–60 minutes to reach Midtown Manhattan. The upcoming Metro-North stop will offer a direct ride into Penn Station (Midtown West) in an estimated ~18 minutes[21] – effectively putting Parkchester just a quick express ride from Manhattan’s core. This dramatic cut in commute time (a ~40-minute reduction each way) is expected to elevate Parkchester’s appeal for commuters and significantly improve its “price-to-access” proposition[21]. Similar transit improvements in NYC have historically driven rent and price growth in newly linked neighborhoods, as shorter commutes broaden the pool of renters and buyers. While the full impact will unfold over the long term, investors are already viewing the new station as a catalyst that could unlock Parkchester’s value. Importantly, current pricing in Parkchester does not yet fully reflect this future convenience – presenting a potential arbitrage opportunity (as discussed below). In addition to transit, ongoing local initiatives (e.g. NYC’s “City of Yes” zoning reforms and proposed tax abatements) aim to spur housing development in outer boroughs[20]. Over time, such pro-housing policies and infrastructure upgrades should support the Bronx’s growth, making areas like Parkchester even more integrated into the city’s economic fabric.

Investment Fundamentals: Values & Yields

From an investment perspective, Parkchester offers attractive fundamentals relative to more established NYC submarkets. One key indicator is capitalization rates (cap rates) – i.e. initial yield on rental property. In today’s market, NYC multifamily cap rates average ~5–6%[22] after rising with interest rates in 2022–23. However, there is a sharp bifurcation: prime Manhattan assets still trade at low yields (often sub-4% for trophy properties)[23], whereas outer-borough and secondary market cap rates lie in the mid-5% to 6%+ range[22][23]. The Bronx, in particular, has seen cap rates in the high-5% to 6% range for stabilized multifamily deals, reflecting both higher perceived risk and greater income yield[22]. Parkchester’s condo units, when rented, similarly demonstrate above-average yield metrics. At a median sale price of ~$250,000 per unit (roughly $349 per square foot in recent listings)[24] and median rents around $2,200, the price-to-rent ratio is on the order of 9–10X (annual rent), implying a gross yield in the high single-digits. Even after accounting for common charges and expenses, this suggests cap rates that can exceed 5% – a healthy spread versus Manhattan’s ~3–4% on comparable units[23]. In other words, investors can acquire income streams in Parkchester at a far lower multiple of rent (and higher cap rate) than in Manhattan or Brooklyn, enhancing cash-on-cash returns and cushioning against interest costs. This yield premium compensates for factors like the Bronx’s historically higher perceived risk and lower liquidity, but it also highlights an arbitrage opportunity if those risk perceptions change.

Perhaps the most striking metric is Parkchester’s pricing per square foot relative to its transit accessibility. Currently, Parkchester condos trade around $350 per sq. ft.[25]. By contrast, apartments in “sub-20-minute” commutable neighborhoods of Manhattan, Brooklyn or Queens often command on the order of $1,000 per sq. ft.[25] (with Manhattan condos averaging $1,600–$2,000/ft² in many areas[26]). Even other gentrifying Bronx areas have seen multifamily trades above $500/ft² for free-market product in recent years.

This ~3× valuation gap – Parkchester at ~$350 vs. ~$1,000 in comparably transit-proximate locales[25] – signals a potential price-to-access mispricing. Parkchester’s residents will enjoy essentially the same 15–20 minute Midtown commute as many prime neighborhoods once the new rail station is operational, yet current pricing has not caught up to that reality[21][25]. For long-term investors, this suggests room for Parkchester values to appreciate faster than the city average as market perceptions evolve. Indeed, the Bronx has already been on an upswing: home prices in the Bronx climbed about 38% from 2010 to 2020[27], outpacing Queens and Staten Island, and more recently Bronx properties have transacted at discounts due to regulatory overhang – providing savvy investors a low basis. Over the last 6 years, even Manhattan’s rent growth was only ~2% (stagnant due to a mid-decade dip) while the Bronx’s rent growth exceeded 60%[28][8].

Looking forward, long-term appreciation prospects in Parkchester appear strong as the area benefits from Bronx-wide growth drivers but starts from a low price base. The Bronx’s outlook is “exceptionally bright,” according to market analysts, given a convergence of pro-housing policy and transformative transit investments anchoring future growth[20].

Crucially, we approach these fundamentals with a balanced, data-driven view. Parkchester’s relative discount comes with considerations: historically, the Bronx has had higher unemployment and lower income levels than Manhattan, which can cap rent growth and resale velocity. Regulatory changes (e.g. 2019 rent stabilization laws) also hit Bronx multifamily assets particularly hard, as evidenced by some distressed sales at <$130/sf for rent-regulated buildings[29]. However, Parkchester’s niche – free-market condominium units in a well-run complex – sidesteps many of those regulatory risks while aligning with the city’s urgent need for middle-income housing. Occupancy has proven resilient (boosted further by programs like HUD-VASH vouchers for veterans), and collections are reliable even through economic cycles. Meanwhile, the broader capital markets are stabilizing: after a period of cap rate expansion, NYC multifamily values have found a floor in mid-2025, and any future interest rate relief could spur cap rate compression (i.e. rising values) given the city’s strong fundamentals[30][31]. For an institutional investor or family office, the risk/reward profile in Parkchester is thus compelling. You obtain a high current yield and significant appreciation upside (from both operational improvements and market re-rating) – all against the backdrop of New York City’s deep rental demand and new infrastructure that is set to bridge Parkchester’s value gap. In summary, Parkchester represents a case of price-to-access arbitrage: a well-located New York City community priced at a fraction of peers, with market trends and forthcoming transit connectivity serving as catalysts for value convergence in the years ahead[32][25].

Sources: City of New York, NYU Furman Center, MTA, Realtor.com, MMCG Invest (2025 Multifamily Report), Brevitas (NYC Market Update 2025), Ariel Property Advisors (2025 Bronx Report), and TIRIOS Capital research. All data as of 2024–2025. Citations available upon request.[3][8][21][25]